- 1. It is often said that change is the only constant, and yet managing change in modern companies challenges everyone who attempts it. This change could be a digital transformation or the more traditional merger and acquisition activity that regularly hits peaks in different industries.

- 2. Do your homework

- 3. Making two become one

- 4. The devil’s in the detail

It is often said that change is the only constant, and yet managing change in modern companies challenges everyone who attempts it. This change could be a digital transformation or the more traditional merger and acquisition activity that regularly hits peaks in different industries.

Indeed, there are indications that M&As are increasing again in as the world recovers from the pandemic. Regardless of the motivation, companies that seek to implement major organisational change often risk costly failures [McKinsey, 2018; Martin, 2016].

Imagine, then, the scale of the challenge when faced with a merger/acquisition of two digitally transformed companies! You have to cope with the usual concerns of all M&As and a whole set of new ones relating to the digital world:

- Combining the finances of both companies

- Harmonising the management structures

- Identifying how to merge duplicated functional areas

- Creating a master data set covering products, vendors, and clients

- Establishing an information technology environment that supports the new digital structure

In essence, the companies need to be digitally transformed again. And yet, as Tomasz Młodecki discussed in a previous article, this aspect is often overlooked with serious consequences for the new enterprise. These can include reduction in workers’ efficiency, deterioration in customer service quality and even temporary shutdowns in production.

How can this be avoided? Can aspects of managing M&As be applied to managing the integration of two digital systems?

Do your homework

Any merger or acquisition needs to be justified in advance by defining its strategic objectives during the due diligence process, and this is especially important in the digital world.

This process starts with a vision that articulates how to harness computer-based digital technologies to achieve strategic objectives based on the organization’s own digital business model.

Many well-established companies have disappeared in a remarkably short space of time because they neglected the digital space in their plans. As research analyst Nigel Fenwick of Forrester comments, “What every company needs is a solid business strategy built around tomorrow’s digital capabilities.”

The initial steps taken when contemplating a merger or acquisition must consider the influence of the digital world:

- Understanding the market, your place in it and the needs of existing and potential customers.

- Analysing where the market is heading and the potential for your organisation to be a digital disruptor (rather than being disrupted by others).

- Evaluating your value proposition in light of these insights.

- Developing a vision and strategy of how the new organisation should initially position itself after the M&A and then evolve in the future to meet customers’ needs and expectations.

- Creating a digital roadmap which shows a way to move from the current state to the future state.

Based on the strategy you develop, you can then decide on the digital structure needed to deliver it. For example, if the target is greater process efficiency then you will need tools to gather data to understand where and how your operations meet your customers’ requirements (and if they don’t), so you can then identify areas of waste and develop a better way of doing things

You should also assess the adoption level of digital tools in each company. Don’t only consider technology, processes and infrastructure — what digital skills are available in the workforce?

What additional capabilities will be needed to go through the required process smoothly?

What can one company teach the other about operating digitally?

Unless both companies are identical in their level of digital adoption — highly unlikely — then work will be needed to align them.

Making two become one

Having done your due diligence and completed the deal, first and foremost, you need a CIO (Chief Information Officer) on the board of the new business who understands the overall strategy and can identify the digital tools needed to deliver it. It’s essential that IT is seen as a vital asset for a digital business to achieve its strategy, and not simply as a cost.

In recent years, companies have often been tempted to outsource their IT to cloud-based service providers. While this brings advantages in reduced staffing and infrastructure costs, it can lead to a lack of internal expertise which risks undervaluing IT within the business. It also reduces the company’s ability to conceive future digital strategies that capitalise on emerging technology drivers such as AI, cloud computing, and the Internet of Things.

Since IT provision is the foundation of delivering any digital strategy, projects set up to develop the new digital infrastructure needed must be fully costed. This may seem obvious, but underestimating IT challenges has previously been highlighted as a reason for failure in numerous M&As.

Equally, do not underestimate the importance of cultural change. If a company needs to adopt new ways of working to deliver a strategy, such as DevOps, then departments who previously worked quite separately, such as software development and administrators, need to learn how to cooperate. Innovative working methods need more than new tools and processes if they are to succeed. They also need a shift in mindset and an acceptance of the resulting change in the culture of the company.

The devil’s in the detail

When two businesses merge, there is a lot of essential but unglamorous work that needs to be done straight away in addition to the more exciting strategy announcements and rebranding exercises. In digital landscapes, this includes the vital step of locating and merging the data from the two companies.

You cannot have a truly successful M&A between digital companies without the complete integration of data across all functions. Silos where separate teams report and analyse different datasets on any aspect of the business must become a thing of the past. And while this might sound like a daunting challenge, remember that it is much easier (and therefore cheaper) to do this at the point of merger/acquisition than trying to remould the new company once it is established.

A business needs a single source of truth. Source: C&F

Too often, merged businesses have legacy systems that compete with each other. Multiple ERPs are not uncommon but cause huge problems. What if the same customer or vendor appears in more than one system? How do you manage rebates? How do you manage refunds? How are sales territories aligned? How will this affect sales reps? The list goes on, and becomes even more complex if you take into account the millions of transactions that are exchanged with business partners through these systems.

A business needs a single source of truth, and companies like C&F, who are the experts in data management, can codify logical rules for merging and matching data from competing systems. This exercise creates a master data set for the final consolidated ERP that forms the basis of all key business processes in the company.

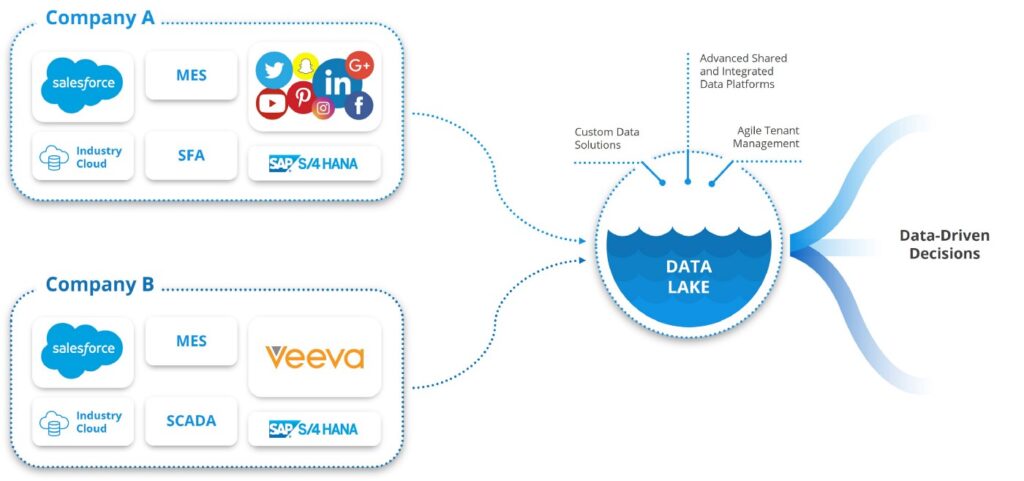

Where merged companies have other systems that propagate data then, to avoid data-separating silos and contradictory reporting, C&F can provide a pooling of everything into a “data lake”. This gives further insight and allows you to draw unambiguous conclusions, which can be used to develop the new business even further.

Many factors affect the success or failure of a digital transformation. When done well, it leads to profound change within a company. Similarly, the changes caused by the merging of two companies or the acquisition of one by another must be managed carefully to maximise the benefits.

Would you like more information about this topic?

Complete the form below.