The Challenge

As a subsidiary of a major organization, Origen Financial Services is required to carry out their risk management and other processes in alignment not only with corporate standards, but most of all with the necessity to comply with legal regulations that differ depending on the market of operation.

Problems to solve

- Low efficiency of risk management processes due to manual, spreadsheet-based methods of operating

- No collaboration tools for risk management teams

- Compilation and collation of information consuming most of the risk management team’s work time

- Not enough time available for the risk management team to analyze the data for trends and patterns and to optimize risk resolution efforts

The solution

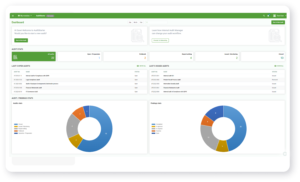

AdaptiveGRC Enterprise Risk Manager implemented to ensure compliance with corporate standards and risk management procedures:

- Configuration of the AdaptiveGRC Enterprise Risk Manager module to replicate the required company risk framework including probability and impact grid with a pre-defined scale and heat map matrix

- Setting up AdaptiveGRC up to meet to the existing risk register selection criteria

- Importing the entire legacy risk register into the system

Results

- 70% faster Automation of the Risk Management Process

- 50% error probability reduced

- 30% more Accurate Reporting and Data Analysis Capabilities

- 50% more Time Available For Risk Data Analysis

Origen Financial Services needed an effective risk management tool and we delivered